In the lively ongoing debate on practice valuation, consultant Thomas Climo, PhD, weighs in with his reply to the two-part series by Tim Lott and colleagues that ran on March 13 and March 20.

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.This column comprises my response to the case made by Lott and colleagues earlier this month on DrBicuspid.com. In my writings here, I have consistently proposed two valuation models, which their series disagrees with.

The first part of the Lott et al argument drives off the notion of opportunity cost, claiming better investments exist in the market at the price I value a practice. The second part claims mathematics demonstrates my valuation metric would throw the buyer into a permanent loss situation. While their valuations and mine differ, here is the wheel of valuation that is not in dispute.

Companies, such as dental practices, buy or rent assets -- for example, human resources, scanners, x-ray machines, computers, monitors, drills, drill bits, and so on. Assets are used to generate revenue -- mostly in the clinic for dentistry -- which is then applied to all expenses to create earnings before interest, taxes, depreciation, and amortization (EBITDA) and genuine net income, with "genuine" meaning after capital maintenance has been ensured through a verifiable depreciation expense. EBITDA, through a multiples rate or net income (the bottom line number from the income statement), is then "capitalized" to determine the valuation of the company or dental practice.

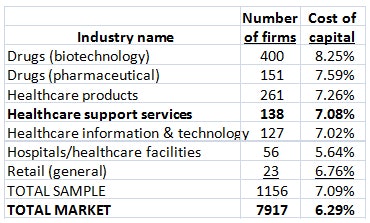

EBITDA or net income is capitalized by utilizing the empirical cost of capital in the NYU Stern data set: Cost of capital is the measure of opportunity cost and consists of the cost of equity and debt; it is equivalent to the hurdle rate of return necessary for an investor to trade in the stated industry. While more than 100 industries are listed in the NYU Stern table representing 7,917 companies, the sample list below focuses on healthcare and retail.

Every company, including a dental practice, is valued in this manner in every country in the world. Cost of capital percentages may change in each country, but the manner of valuation does not.

Therefore, if a dental practice earns $150,000 of genuine net income, it is then capitalized to determine the value of the practice. The rate of capitalization or cost of capital is the driver for this valuation. Here is how I put it in the article that began the debate with Lott and colleagues:

- $150,000 of net income is divided by the healthcare support services cost of capital of 7.08% = $2,118,644.

- In a prior year, the $150,000 of net income was divided by private equity cost of capital of 9.46% = $1,585,623.

Lott and colleagues determined that the $150,000 of net income has a valuation with a multiple rate of six times net income (or lower) = $900,000.

Transferring their valuation into the worldwide accepted valuation formula means using the cost of capital solved for below: $150,000 ÷ X% = $900,000. Solving for X%, the cost of capital = 16.66%.

This cost of capital (16.66%) is higher than the 7.08% for healthcare support services and also higher than an all-industry average cost of capital of 6.26%. In fact, this cost of capital is higher than every other industry in the NYU Stern list, including the risky oilfield services industry of 9.46% and consumer electronics of 9.78%.

How off the wall and against the grain of other industries is their finding? And two of the contributors to the article are lenders who know full well that the cost of debt, a component of the cost of capital, for the dental industry has never been as high as 16.66% in any year, much less for January 2015.

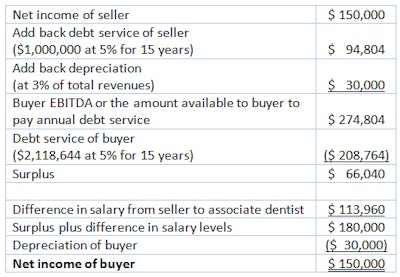

We now come to the Lott and colleagues' cash flow or math scenario, which concludes that a higher sales price would throw the practice into loss. Their analysis is at fault for not taking out the existing loan cleared at closing. The buyer is not debt servicing two loans with the $150,000 of net income -- in fact, is not paying debt out of net income at all, but EBITDA. As the high cost of capital in their analysis refutes the opportunity cost piece of the Lott et al reasoning, the simple example below corrects their math. Remember, debt is serviced with EBITDA and not net income.

The inability of the buyer to debt service the alleged high valuation is as much a fiction on their part as their high cost of capital alleged for dentistry. The EBITDA of $274,804 clearly covers debt service of $208,764.

Moving into operational trimming, when the new owner replaces the old owner's salary (say, $300,000) with an associate-type salary ($186,040), this $66,040 surplus grows to $180,000. Deducting $30,000 from the $180,000 for depreciation to maintain capital intact generates the identical net income for the buyer as the seller generated of $150,000. There is no loss of net income much less an outright loss to the buyer at this price valuation.

Of course, if it is a private equity buy, there is no debt, and their argument crumbles.

Dentistry continues to allow antiquated and outdated valuations to be employed by the transition industry for the sole purpose of maintaining status quo. The method proposed in their series is unsound, refutable, and -- worse -- against the grain of valuation for every other industry in the world.

Thomas Climo, PhD, is a professor emeritus of accounting and finance at a major university in the U.K. He has published extensively about the importance of modern managerial and financial decision-making for dentistry. He is a consultant to corporate and solo practitioner dental practice management companies in the states of Arizona, California, Connecticut, Nevada, New Hampshire, New York, and Massachusetts. He can be reached by email at [email protected] or by telephone at 702-578-2757.

The comments and observations expressed herein do not necessarily reflect the opinions of DrBicuspid.com, nor should they be construed as an endorsement or admonishment of any particular idea, vendor, or organization.